Fraud?! Lower your Farm Risk

As an independent Farmer, your plate is full: raising and harvesting quality products, marketing, selling, and fulfilling orders. The last thing your business needs to worry about is fraud and privacy issues. Unfortunately, fraud is rampant today in the digital era, costing businesses hundreds of billions of dollars every year. As small business owners, Farmers are particularly vulnerable to online schemes and hackers. In the absence of the right safeguards, your Farm could be exposed to significant financial losses and liabilities.

Understanding the Risks to Your Farm Business

Fraud and security breaches pose two major threats to your Farm's online operation: financial loss from fraudulent purchases and liability from privacy breaches.

Financial Liability from Fraud

Your Farm is a tempting target for online perpetrators using stolen credit cards in what are known as "carding attacks." These bad actors, who can be anywhere in the world, specifically target eCommerce stores with fraudulent orders. Here's the critical part: your Farm is liable for all losses resulting from these stolen credit card transactions. In the absence of implementing best practices, your Farm business could incur major financial hits and waste time dealing with chargebacks and lost products.

The High Cost of Privacy Breaches

Beyond financial fraud, hackers actively seek to steal non-financial information, most notably your customers' contact details. This data is often used in ransomware attacks to blackmail small business owners for major sums of money or may be sold through underground markets. The liability for privacy breaches is significant. Court settlements often require business owners to pay for three years of credit monitoring per stolen record, which costs roughly $300 for each contact record. For example, a Farm with just 100 customers could be liable for a potential $30,000 expense in the event of a privacy breach.

Best Practices to Lower Your Farm Risk

In a world with an increasing number of bad actors looking to capitalize on "soft targets" like small business owners, minimizing your risk and liability is essential. While no solution is perfect, there are a number of best practices that can be implemented to significantly reduce your Farm's exposure and limit liability.

1. Transaction Monitoring

These critical tools conduct a real-time risk and fraud assessment for every single attempted transaction on your eCommerce storefront. This involves looking for signals of suspicious or dubious activities, such as high-volume, small-dollar orders placed at odd hours, or off-shore purchase attempts with domestic credit cards. Although costly, real-time transaction monitoring is one of the best defensive moves to curtail fraud.

2. Automated Code Scanning

Automated code scanning analyzes the source code of software to uncover potential bugs and security vulnerabilities that could be leveraged by hackers to steal credit card or customer details. This should be applied not only to your Farm's eCommerce store but also to data gathered from your website, email capture forms, or social media accounts.

3. Ongoing Security Audits

Routine security audits, conducted by outside, certified security consultants, help to proactively uncover potential issues and improve product development and engineering practices. These audits are critical because they provide an extra layer of assurance that your Farm's exposure to risk is minimized.

4. Cyber Security and Privacy Insurance

In a world filled with nefarious actors, obtaining insurance to protect your business exposure and liability for a potential eCommerce or privacy breach is a must-have. These policies are often expensive to procure on your own, which is why it's wise to choose vendors who extend such protections to your Farm.

Trust a Solution Built for Farmers

As a Farmer, your time is limited and better spent on your products and customers. You shouldn't have to become a cybersecurity expert to sell direct-to-consumer.

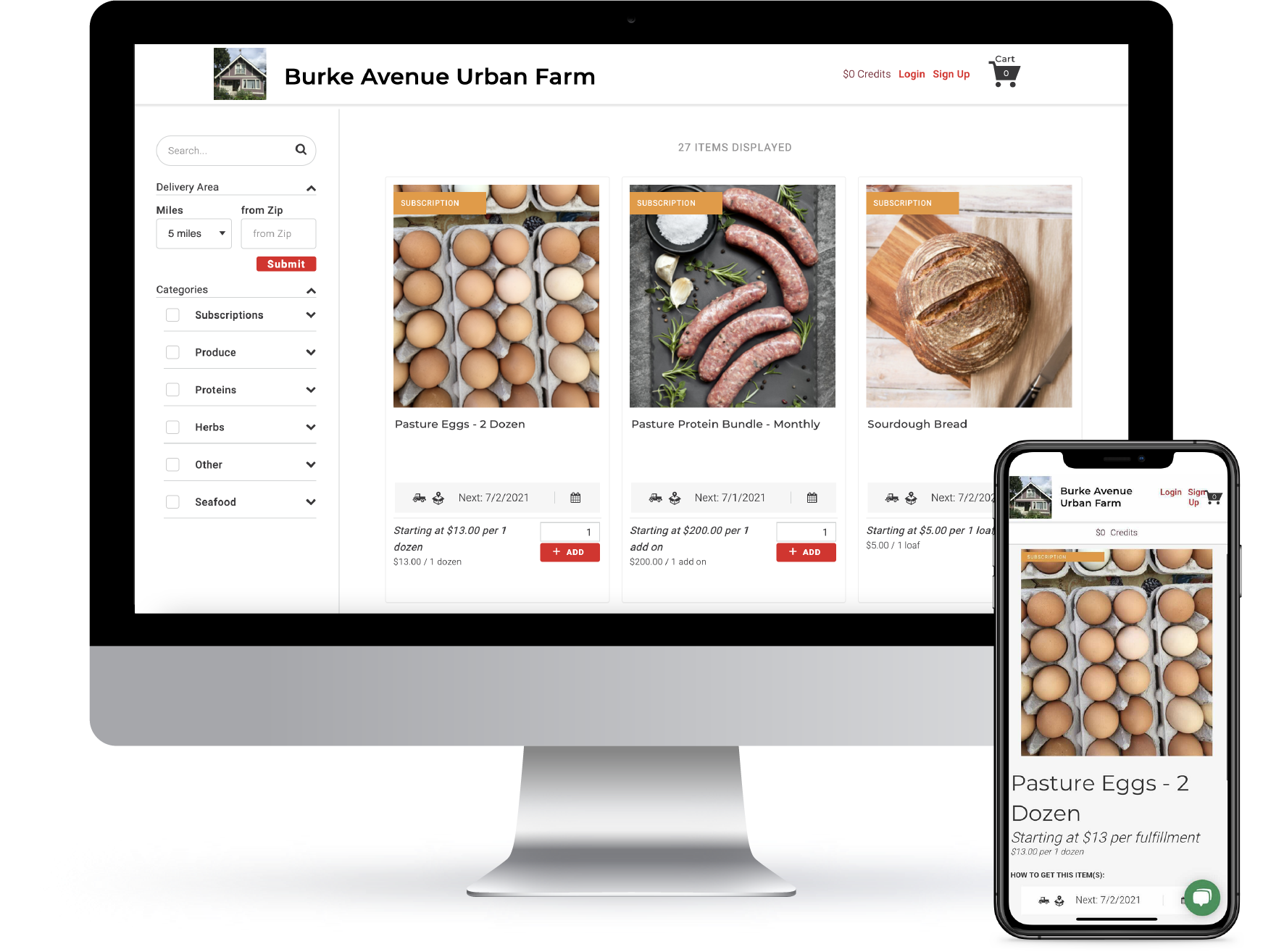

In an evolving landscape of threats and bad actors, Barn2Door has implemented these best practices as part of our standard service offering to 1000’s of Farms in all 50 states. We're dedicated to serving independent Farmers with a safe and secure eCommerce platform.

In fact, among the millions of transactions processed via Barn2Door, every attempt is inspected for potential fraud. Over the preceding 12 months, Barn2Door has helped Farms avoid more than $500,000 of suspected fraudulent orders.

Conclusion

When you choose to work with Barn2Door, your Farm benefits from the largest team in America dedicated exclusively to serving independent Farmers. We provide a safe and secure platform that has attained Payment Card Industry (PCI) compliance for all your online and in-person transactions.

By leveraging Barn2Door's secure platform, you can focus on building your Farm brand, growing your products, and serving your local Buyers, confident that our robust platform is working in the background to protect your business.

What steps have you taken recently to review your Farm's online security and privacy protection?

Barn2Door offers software for Independent Farmers to create and promote their brand, sell online and in-person, and save time managing their business. If you’re curious to learn more, watch this 5-minute video.